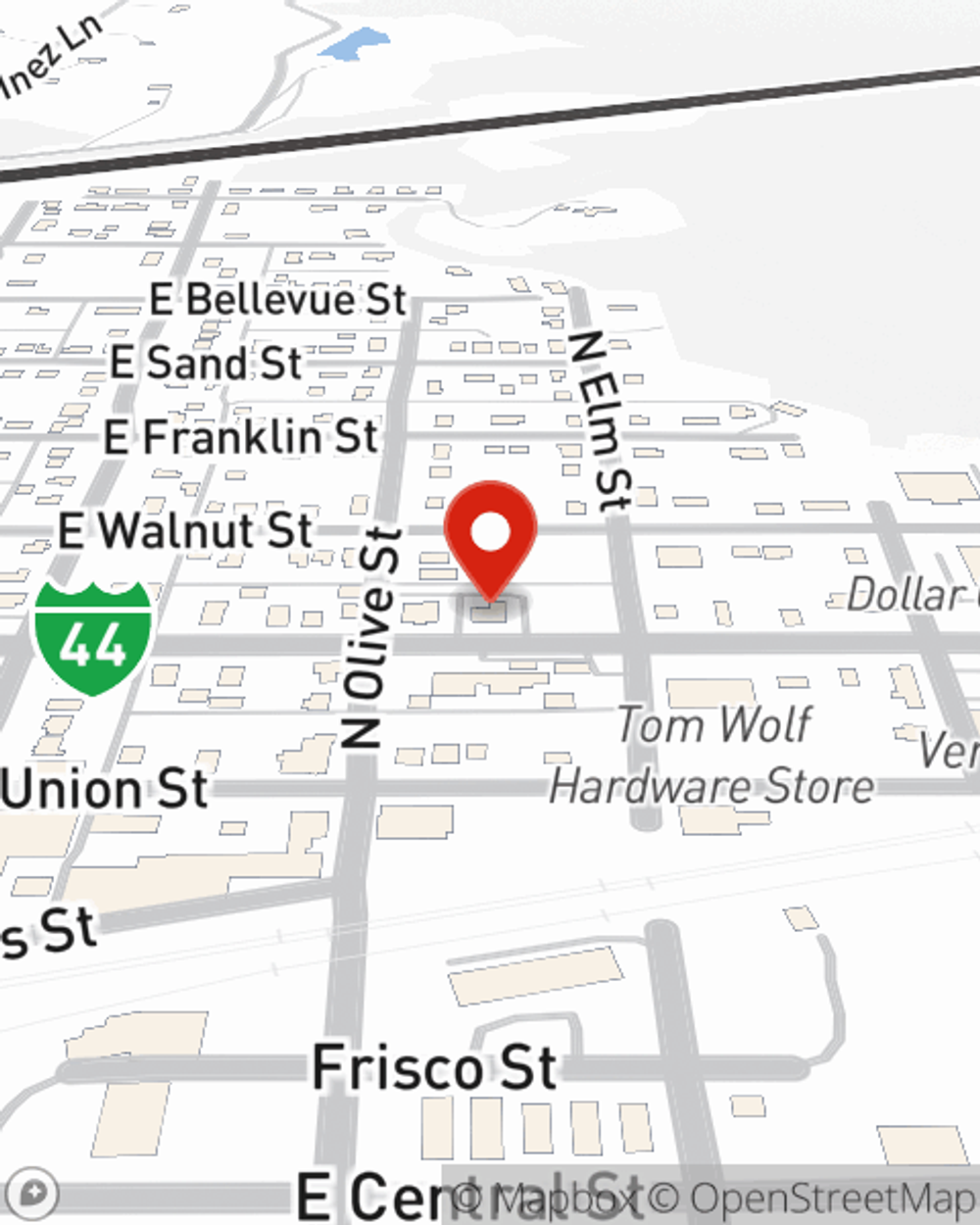

Business Insurance in and around Pacific

One of Pacific’s top choices for small business insurance.

No funny business here

- Pacific

- Eureka, MO,

- Fenton, MO

- Ballwin, MO

- Wildwood, MO

- St. Louis, MO

- Ellisville, MO

- St Charles, MO

- Washington, MO

- Chesterfield, MO

- Labadie, MO

- St Clair, MO

- Sullivan, MO

- Catawissa, MO

- Franklin County, MO

- St Louis County, MO

- High Ridge, MO

- Jefferson County, MO

- St Charles County MO

- Villa Ridge, MO

- Robertsville, MO

Insure The Business You've Built.

Do you own a hobby shop, a stained glass shop or a florist? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

One of Pacific’s top choices for small business insurance.

No funny business here

Protect Your Future With State Farm

When one is as dedicated to their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial liability umbrella policies, artisan and service contractors, business owners policies, and more.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Brian Smith is here to help you learn about your options. Reach out today!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Brian Smith

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.